FTAI to Acquire W&LE: Freight Rail Infrastructure Expansion

FTAI Infrastructure buys Wheeling & Lake Erie Railway for $1.05B, expanding freight rail network. Deal, expected Q3 ’25 close, subject to approvals.

FTAI Infrastructure to Acquire Wheeling & Lake Erie Railway in $1.05 Billion Deal

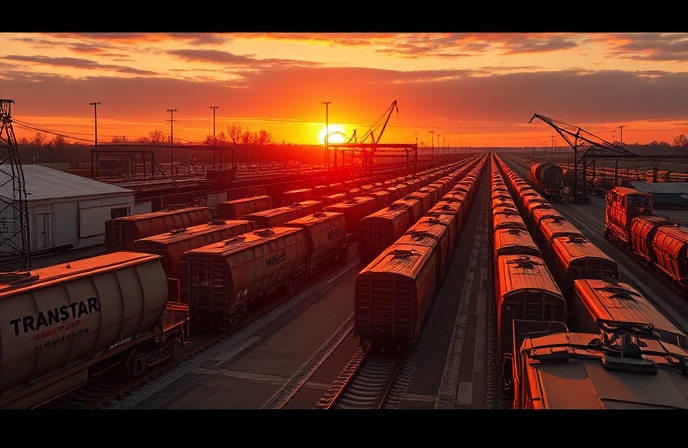

In a move set to reshape the regional freight landscape, FTAI Infrastructure has announced its intention to acquire The Wheeling Corporation, the parent company of the Wheeling & Lake Erie Railway (W&LE). This $1.05 billion all-cash transaction, announced on August 8, 2025, is expected to close in the third quarter of this year, pending regulatory approvals and customary closing conditions. The acquisition brings together two significant players in the North American rail sector, with FTAI seeking to integrate W&LE into its existing Transtar operations. This article delves into the details of the agreement, exploring the strategic rationale, financial implications, and the anticipated impact on the future of freight rail in the regions served by W&LE.

Strategic Rationale: Expanding the Freight Rail Platform

The acquisition of W&LE aligns with FTAI’s strategic goals to expand its footprint in the freight rail sector. As stated by FTAI CEO Ken Nicholson, “Growing our freight rail platform has been a key focus for FTAI, and we are thrilled to have this opportunity to combine with the W&LE.” The W&LE, a Class II regional freight railroad, operates over 1,000 miles of track in Ohio, Pennsylvania, West Virginia, and Maryland, serving over 250 customers. The acquisition provides FTAI with increased scale, diversification, and network reach, complementing its existing operations. The integration of W&LE with Transtar is expected to unlock significant synergies, driving revenue and EBITDA growth through identified growth opportunities and operational efficiencies.

Financial Framework and Transaction Details

The transaction involves FTAI Infrastructure acquiring The Wheeling Corporation from an entity controlled by Larry Parsons, the CEO of The Wheeling Corporation. The $1.05 billion purchase price will be funded through a combination of debt and equity. Concurrently with the closing of the acquisition, FTAI plans to refinance its existing 10.50% senior notes and Series A preferred stock. To support these financial activities, FTAI has secured commitments for a total of $2.25 billion in capital, encompassing $1.25 billion in new debt and $1 billion in preferred stock. The preferred stock will be purchased by funds managed by Ares Management and issued through a newly formed holding company. This holding company will oversee the merged Transtar and W&LE operations once regulatory approvals are received.

Regulatory and Operational Considerations

The acquisition is subject to approval from the U.S. Surface Transportation Board (STB). The transaction is expected to be placed into a voting trust pending final STB authorization, as per standard industry practice. Once STB approval is granted, FTAI will assume operational control of the W&LE, and the W&LE will become an affiliate of Transtar. This process ensures adherence to all regulatory requirements and allows for a smooth transition. The STB’s review will focus on ensuring the transaction does not negatively impact competition or service levels within the affected regions.

Company Summary

FTAI Infrastructure is a key player in infrastructure investments, with a focus on transportation assets including rail. Their strategy revolves around acquiring and optimizing infrastructure businesses, particularly in the freight rail sector. The Wheeling & Lake Erie Railway (W&LE) is a regional freight railroad operating in the Ohio, Pennsylvania, West Virginia, and Maryland regions. The W&LE, a Class II regional carrier, connects with several major Class I railroads providing connections to major ports and markets.

Conclusion

The acquisition of the Wheeling & Lake Erie Railway by FTAI Infrastructure represents a significant development in the freight rail industry. The consolidation is expected to enhance operational efficiencies and offer expanded services to customers across the combined network. The successful integration of W&LE into Transtar will hinge on seamless operational harmonization and leveraging synergies within the existing infrastructure. The financing strategy, encompassing new debt and preferred stock, signals confidence in the long-term value creation potential of the combined entity. Furthermore, it underscores the ongoing trend of strategic consolidation within the rail sector. This deal demonstrates a commitment to investing in and expanding rail infrastructure in the regions served by W&LE and supporting the efficient movement of freight. The industry will be watching closely to gauge the progress and impact of this major consolidation within the freight rail landscape as the combined entity seeks to compete more effectively.