Trinity Industries Restructures, Projects $1.50 EPS Boost

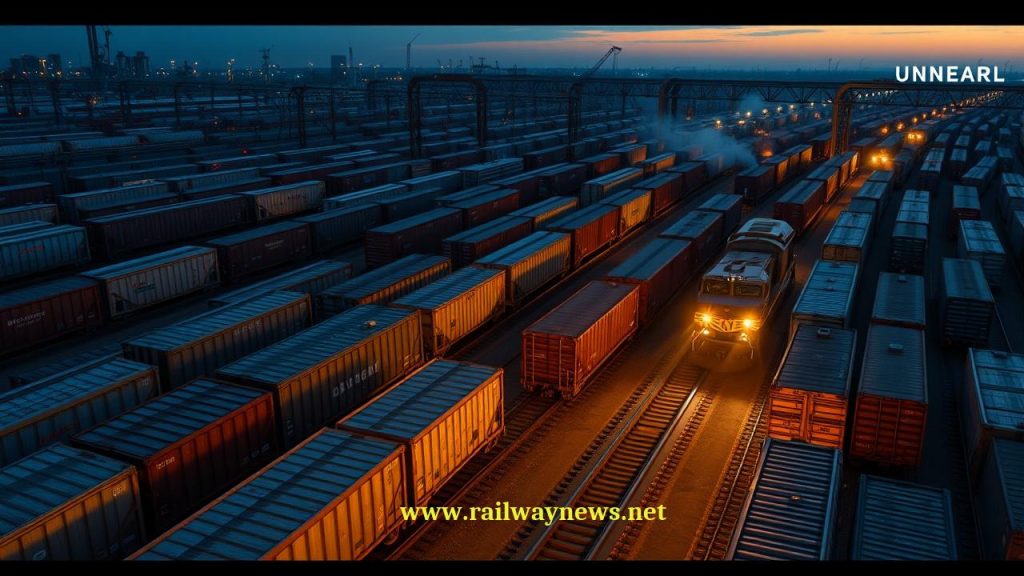

Trinity Industries restructures, boosting 2025 EPS by $1.50. Gaining control of a 6,200+ car fleet strengthens its position in the rail market.

DALLAS, TX – Trinity Industries has completed a major strategic restructuring of its rail-car investment partnerships with alternative credit platform Napier Park, a move that significantly streamlines its portfolio and adds an anticipated $1.50 to its 2025 earnings per share. In response to the value unlocked by the transaction, the railcar giant has raised its full-year 2025 EPS guidance to a new range of $3.05 to $3.20.

| Category | Details |

|---|---|

| Transaction Type | Strategic Restructuring of Rail-Car Investment Partnerships |

| Key Parties | Trinity Industries Inc., Napier Park |

| Effective Date | December 30, 2025 |

| Anticipated 2025 EPS Impact | +$1.50 per share (New Guidance: $3.05 – $3.20) |

| Key Asset Exchange | Trinity gains 100% ownership of RIV 2013 fleet (>6,200 cars); Napier Park acquires 99.8% of Triumph Rail Holdings |

Trinity Industries announced on December 30, 2025, the successful completion of a series of transactions designed to reshape its joint ventures with Napier Park. The deal realigns ownership of tens of thousands of rail cars, simplifying Trinity’s investment structure and providing a substantial, immediate boost to its earnings forecast. The move is a clear signal of Trinity’s focus on optimizing its balance sheet and maximizing shareholder value from its extensive leasing fleet.

The restructuring involved a complex shuffle of assets and ownership stakes. Prior to the deal, Trinity held a 43% stake in TRIP Rail Holdings LLC, which controls over 17,000 rail cars, and a 31% stake in RIV 2013 Rail Holdings LLC, which owns a fleet of more than 6,200 cars. Through the transaction, Trinity has acquired sole ownership of RIV 2013 and its subsidiary TRP 2021 LLC, bringing that 6,200+ car fleet entirely in-house. Concurrently, Napier Park has consolidated its control over a portion of the other venture by acquiring 99.8% of Triumph Rail Holdings LLC. The original joint venture structure for Tribute Rail LLC remains in place, with Napier Park holding 57% and Trinity 43%.

This strategic realignment occurs as the broader industrial and materials sectors anticipate strong performance. For instance, market analysts have projected significant year-over-year earnings growth for fiscal 2025 and 2026 in related heavy industries, driven by robust demand. Trinity’s move to consolidate control over a significant portion of its leased fleet allows it to more directly capture the upside from a strong rail leasing market, positioning the company to capitalize on these favorable industry trends and deliver enhanced returns to investors.

Key Takeaways

- Major Earnings Boost: The transaction is immediately accretive, adding an anticipated $1.50 to 2025 EPS and prompting a significant upward revision of Trinity’s full-year guidance.

- Portfolio Consolidation: Trinity now has 100% ownership and control of the RIV 2013 portfolio, a diversified fleet of over 6,200 rail cars.

- Partnership Realignment: The deal clarifies the partnership structure with Napier Park, which now takes near-total control of the Triumph fleet while the Tribute JV continues under its existing ownership.

Editor’s Analysis

This restructuring is more than a simple financial maneuver; it represents a strategic sharpening of Trinity’s focus. By trading a minority stake in a larger, more complex venture for full ownership of a sizable, well-defined portfolio, Trinity gains greater operational control and a more predictable revenue stream. This move simplifies its story for investors, making the company’s value proposition clearer and more compelling. In a market that rewards clarity and direct asset control, this realignment positions Trinity to better leverage the strength of the North American rail leasing market and translate that operational strength directly into shareholder value.

Frequently Asked Questions

- What was the main financial outcome of Trinity’s restructuring?

- The primary financial outcome was an anticipated positive impact of $1.50 to its 2025 earnings per share (EPS). This led Trinity to raise its full-year 2025 EPS guidance to a range of $3.05 to $3.20.

- Who are the main parties involved in this transaction?

- The two main parties are Trinity Industries Inc., a leading provider of rail transportation products and services, and Napier Park, a global alternative credit platform.

- What key assets did Trinity gain full control over?

- As a result of the transaction, Trinity acquired sole ownership of RIV 2013 Rail Holdings LLC and its subsidiary TRP 2021 LLC, which together own a diversified fleet of more than 6,200 rail cars.